[email protected] +91 9540545454

[email protected] +91 9540545454

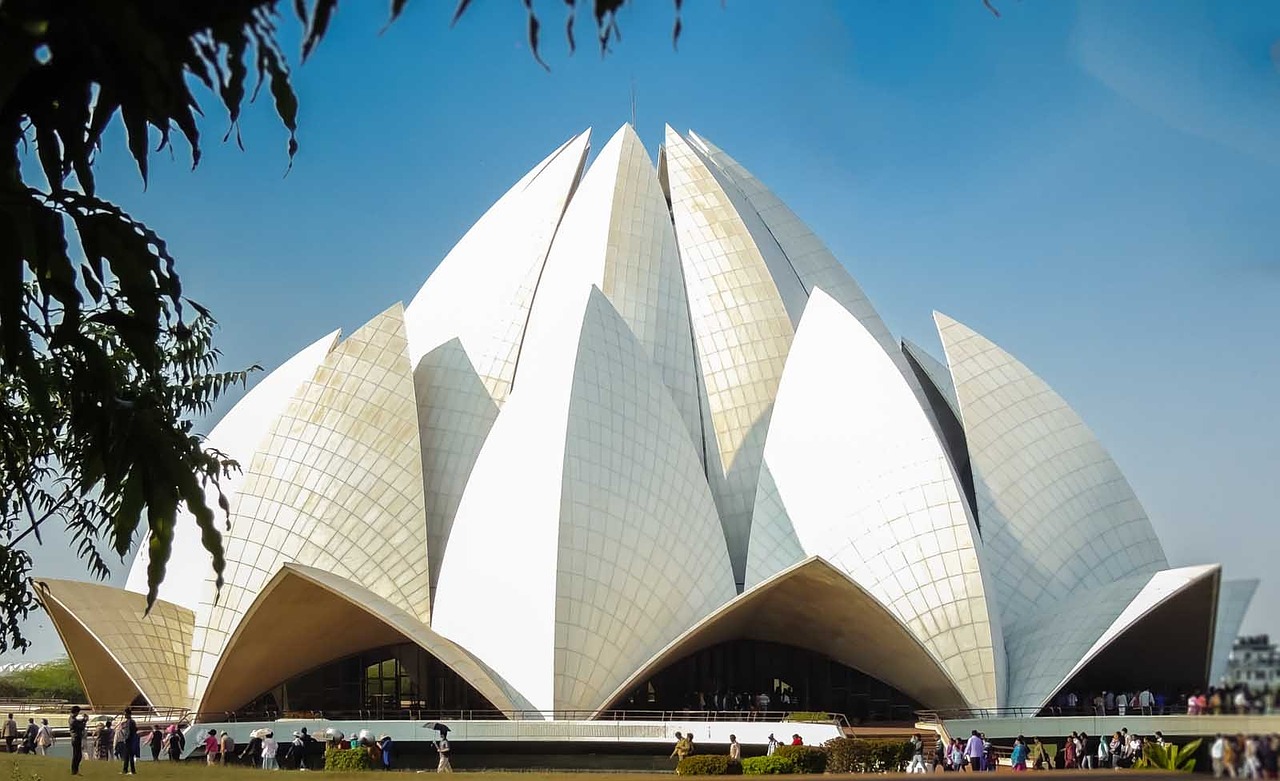

India, country that occupies the greater part of South Asia. Its capital is New Delhi, built in the 20th century just south of the historic hub of Old Delhi to serve as India’s administrative centre. Its government is a constitutional republic that represents a highly diverse population consisting of thousands of ethnic groups and likely hundreds of languages. With roughly one-sixth of the world’s total population, India is the second most populous country, after China.

The Indian real estate market is the second largest employer in the country, while the agriculture sector takes the first place. The real estate sector may have taken a hit due to demonetization and recent government policy decisions, but the industry is well poised to grow in the next 10 years. The Indian real estate market's growth is well complemented by a growing demand for office space and the growth of corporate environment. It remains the most sought-after investment avenue for Indian citizens.

Why Invest in Real Estate in INDIA?

Strong market fundamentals

The last year was bad for the Indian real estate sector in terms of overall valuation due to demonetization and more interference of the government in cash transactions. But because of strong fundamentals, price correction and rising demand in the housing sector, it is very likely that the real estate sector will lead the revival of India economic growth in the coming years.

Regulatory reforms

The introduction of regulatory reforms like RERA and GST in April 2017, coupled with the effects of demonetization have begun to shape up the sector with new standards of accountability, transparency and delivery. These reforms will further have a positive impact on the revival of the Indian real estate sector, resulting in price correction and increasing the investment potential of the sector.

Buyer's market

While demonetization had an adverse affect on the real estate business, it also resulted in slashing land prices, making it a perfect market for new buyers. As the housing sector provides heavy discounts, home loan interest rates are at all-time low. Due to the amendments in the FDI policy by the government, there has been a steady revival of interests from global investment fraternity, too.

Government schemes

Government schemes like PMAY-CLSS and the announcement of 'Housing for All' scheme have also given a boost to the real estate sector. In addition to these schemes, the government has also made affordable housing projects GST exempt. This means that an investor can save a huge amount of tax on real estate investments.

Investment Avenues in Indian Real Estate Spearheaded by IGNIS

You can invest in real estate either through a residential or -commercial property.

Residential real estate

You can invest in the residential real estate by adopting a 'value investing' strategy in ready to move projects. Investing in residential properties at present can allow you to earn rental income and higher returns through appreciation. The urbanization growth is likely to reach 50.3% by 2050 as a result of development in India, which will further increase the profit margin in the residential sector.

IGNIS offers u Pan India Residential Assets like Luxury Properties in urban and second homes in hills or near the beaches. Villas , Apartments, Plots and Banglows / farmhouses are all available with us.

Commercial real estate

For commercial real estate, the rental value in retail space has risen to 27% in metros only over the last four years, providing higher returns because of rising demand and supply shortfall. The consumer expenditure is also estimated to increase, making it a safe and profitable investment option.

Just drop a email to [email protected] today to start a discussion

Make an investment in India today!

Are you interested in diversifying your investments?

IGNIS offers you best investments assets.

IGNIS offers a range of real estate investments to meet the needs of individual clients to corporate funds.